arizona charitable tax credit fund

Arizona Military Family Relief Fund. Maintain a receipt of your gift from the charity to provide a copy with your tax return.

Qualified Charitable Organizations Az Tax Credit Funds

All of the AZ tax credits are subject to limits and restrictions.

. Our Qualifying Charity Organization QCO number is 20941 Tax ID. YOU CAN DONATE TO ANY QUALIFIED CHARITABLE ORGANIZATION OR PRIVATE SCHOOL IN THE STATE. Donate to a certified charitable organization QCO or QFCO such as a 501 c 3 organization like Phoenix.

The Working Poor Tax Credit is part of the Arizona Charitable Tax Credit which is the term used to describe the tax credits for donations to QCOs. The Arizona legislature recently made some exciting changes to the Arizona Charitable Tax Credit. Youll need to give your tax credit donation to this fund by visiting their website here.

Take a Tax Credit on their AZ state return up to 400 dollars each year andor 800 per couple. Tax donations are credited only to individuals. SandRuby Tax Credit Form.

See details and FAQs below. Single filers can now claim up to 400 in gifts to FSL as a dollar-for-dollar tax credit previously 200. A portion of the state tax dollars they owe or already paid to an organization that provides help to the working poor - all at no financial cost to themselves.

The credit is available only to individuals. SingleHOHMFS 200 MFJ 400 This credit must be made in the same tax year to. Make your tax credit donations from one easy-to-use site.

Corporations and companies are not qualified to receive tax credit benefits. Here are five important things that you need to know about Arizona Charitable Tax Credit. This donation must be made before December 31.

This individual income tax credit is available for contributions to Qualifying Foster Care Charitable Organizations that provide immediate basic needs to residents of Arizona who receive temporary assistance for needy families TANF benefits are low income residents of Arizona or are individuals who have a chronic illness or physical disability and provide immediate basic needs. The Arizona Charitable Tax Credit allows an individual to donate up to 400 and a couple to donate up to 800 and receive the full amount back when you. Claim the credit on your Arizona state tax form.

Maximum contributions are 400 for filing single or 800 for filing jointly. Uses Tax Credit Form 321. Claim the charitable deduction on their Federal Tax Return.

What is the Charitable Tax Credit. Through the Arizona Charitable Tax Credit Arizona taxpayers have an added incentive to make a donation and receive a dollar-for-dollar tax credit. DONATIONS FOR TAX YEAR 2021 MAY BE MADE THROUGH APRIL 15 2022.

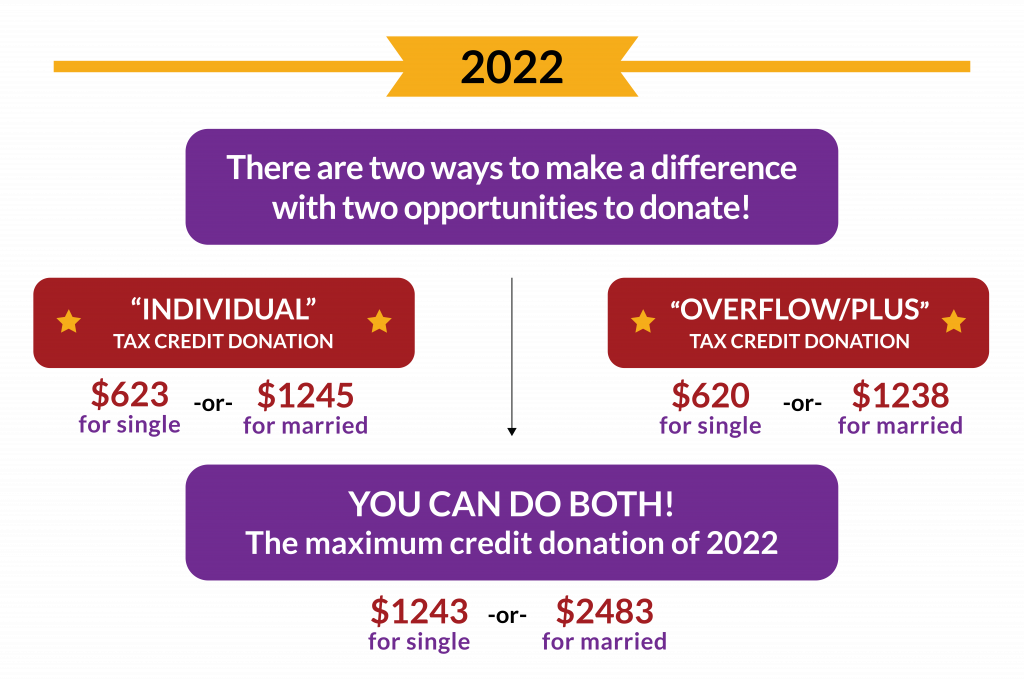

There are two ways in filing for a tax credit each having its respective minimum allowable credit. Donate up to 400 single filer and up to 800 married filing jointly and Arizona will deduct 1 for 1 what you owe. Your donation to the QCO tax credit will support organizations assisting low-income children individuals and families.

Make a gift to MOM AZ Health Partnership Fund up to 400 indiv800 married to maximize tax credit benefit. 2543 - SingleHOHMFS 5083 - MFJ 1 Arizona Military Family Relief Fund Credit. Individuals who pay income taxes to the State of Arizona can redirect their tax dollars to help benefit the SandRuby Community Fund a member of the Handmaker family of services.

This tax code allows for donations to qualifying organizations be returned to the taxpayer not as a deduction but as a tax credit. The link below will go to the Arizona Charitable Tax Credit page to explain how the tax credit helps SandRuby and effects your tax return in Arizona. Also support other charitable causes for additional AZ Tax Credits list available below Make their annual contribution through April 15th or adjusted tax return deadline when the IRS due date is extended.

Contributions for the 2022 tax year can be made through April 15th 2023. This means that you will only receive a benefit to the extent that you have an Arizona State tax liability. 100 OF YOUR DONATIONS WILL PASS THROUGH TO THE ORGANIZATIONS YOU CHOOSE TO SUPPORT.

TOTAL credits available for 2021. For joint taxpayers the maximum credit is 800. Taxpayers report the name of the QCO and the dollar amount of the contribution to Arizona Department of Revenue ADOR on Form 321.

Starting in 2016 the tax credit is 800 for married. This fund can only accept a total of 1 million in donations and if the fund reaches that amount before your donation gets to them your donation will be returned to you. 2519 - SingleHOHMFS 5035 - MFJ Updated amount for 2022.

The State of Arizona has several tax credits which work to decrease a residents income tax liability. Your donation then can be taken as a dollar-for-dollar tax credit on your Arizona income tax. Arizona residents may claim a tax credit for voluntary cash contributions made during any taxable year to a QCO.

The Arizona Charitable Tax Credit allows individuals to donate to a qualified Arizona nonprofit organization and claim a dollar-for-dollar state tax credit. Chapter 2 Limits to the Tax Credit The maximum credit allowed for contributions to QCOs for single taxpayers married filing separately or head of household is 400. How Does the Arizona Charitable Tax Credit Work.

The AZ tax credits are not refundable.

Know Each Tax Credit S Limit 2021 Fsl Org

Cdt Kids Charity Arizona Tax Credit

Arizona Charitable Tax Credit Can Benefit Hcc

Donate To Arizona Tax Credit To Help Children Receive

List Of 6 Arizona Tax Credits Christian Family Care

The Arizona Tax Credit Give Local Old Pueblo Community Services

Qualified Charitable Organizations Tucson Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

List Of 6 Arizona Tax Credits Christian Family Care

Arizona Tax Credits Mesa United Way

Cdt Kids Charity Arizona Tax Credit

Qualified Charitable Organizations Az Tax Credit Funds

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

2021 Arizona Tax Credits Hbl Cpas

Start The Process Az Tax Credit Funds

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S